It’s About Your Customers, Stupid.

Written by Tom Christmann

I needed to refinance my house recently. And if you’ve ever refinanced, or taken a mortgage, you know how time-consuming it can be. The bank needs lots of information about you. They need to know you’re employed. They need to know how much you make. Your credit score. Pay stubs. Assets. Statements. A letter from your dog walker. They want it all.

I tried to do it the usual way. I asked a colleague. He told me he had a great mortgage guy from Bank of America. I gave him a call. He was smart. He spoke in hushed tones about how to work the system. He had just the right loan for me. He told me to send him some an email saying I needed a certain rate and that way he could tell his bosses that he fought the good fight. I did. I had a guy on the inside. He was confident he could help me.

Then he handed me off to other people. These were people I hadn’t talked to. They needed stuff. All of the stuff above (minus the dog walker letter) and more. How did they tell me they needed that stuff? Well, they emailed me. And they sent me packages in the mail. This is how it has been done for twenty years, I told myself. I tried to keep up. I really did.

But I have a job. And I get a lot of emails. And I don’t always check my mail when I get home late. So stuff started to slip. I got more emails. I got voicemail messages. I was told I had stuff to do. And it was on me to get it done. I created to-do lists for myself. I stressed. I missed meetings because I was looking for this statement or that one. I sent messages to my HR people asking for the things I still didn’t have. I called banks and brokerages that I had forgotten the passwords to and asked them to reset those passwords. And then I forgot the passwords again.

One day, I got a letter in the mail saying that my loan status was terminated. I called my guy. He said that I had missed some information and the underwriters needed it and didn’t I check my mail? He started the process over again. But now there was a new wrinkle. My credit score had dropped a bit, (possibly owing to the fact that he had been checking my credit?) so he wasn’t sure he could get me the same rate. He would try, though. Expect a call from one of his associates. I had to email him a few times to make this happen.

So we started again. I now had a new to-do list. The old pay stubs wouldn’t do. I needed new ones. And the statement on my brokerage wasn’t complete enough. And could I fax it all to them? Fax? Honestly? As in facsimile machine. A device patented in 1843. But then it was called the Electric Printing Telegraph.

I called my inside guy. I asked why nobody had called me to tell me I was late on things. And what was happening now. He seemed annoyed to have to talk to me. He told me that I had dropped the ball. He wasn’t rude. But he made it clear that it had been incumbent upon me to do the work and if I couldn’t do it in their system then he couldn’t help me much. But he was trying.

I was angry. I told him that I was in a service business, too. And if my client had “dropped the ball” on approving a television spot that had to ship, it would be my job to make sure to get them on the phone. Failure to do this would be the end of my relationship with my client. He didn’t see it that way. There were procedures. I didn’t follow them. In the end, I felt like just another number in BofA’s database. Not the best brand experience. I told him to stop the new loan, refund my money and that I’d be looking elsewhere for my loan.

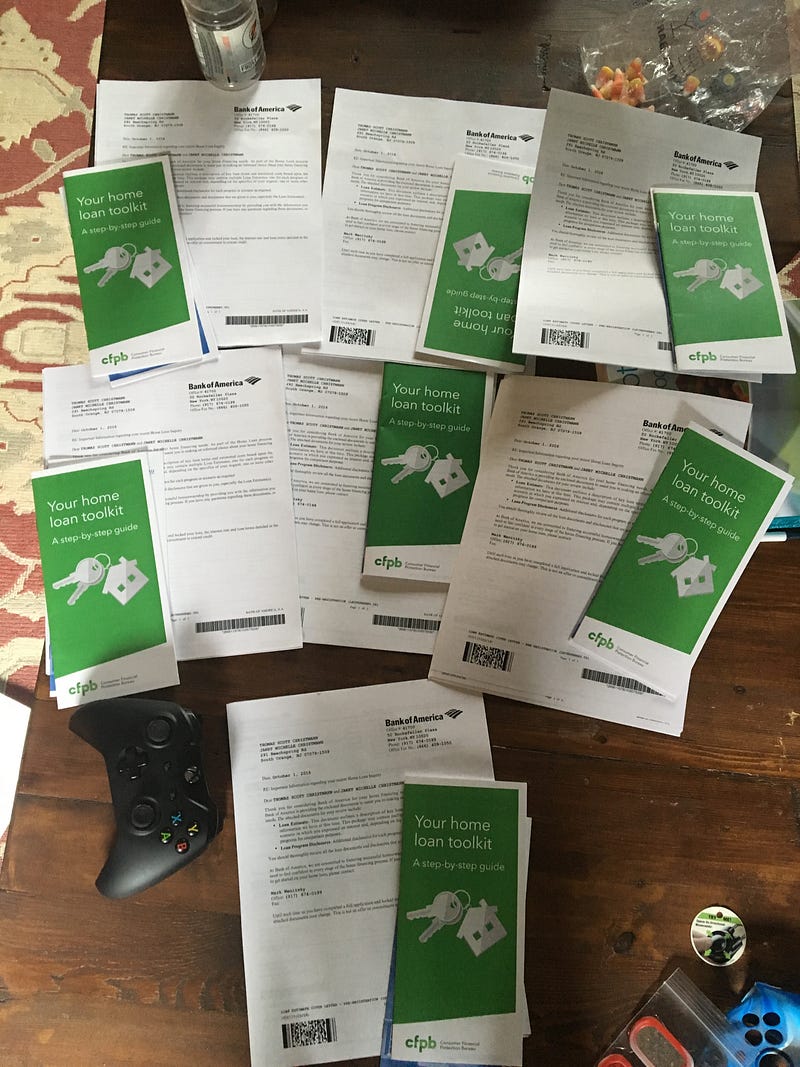

The next week I got seven (yes, seven!) duplicate disclosures for the new loan. I called my guy and asked if he was pranking me. At this point, I could tell in his voice that I was a problem. He condescended to tell me that that’s how it works. He was looking at different products for me and each needed a disclosure mailed out. This was just how it was done. The disclosures had been sent out before our last conversation. But he had cancelled them all. He had refunded my money. Have a good day.

That’s when I found Rocket Mortgage. I had seen the ads saying you could get a mortgage on your phone. It was fast. It was new. It was to banks what Uber was to car services. I downloaded the app and applied. I expected the same crap. But this time at least I had all my documents ready. I wasn’t going to screw up again. Seriously, I felt bad about myself. Thanks Bank of America.

The first thing I noticed about the Quicken Loan experience (Rocket Mortgage is a Quicken product) was how it was all built around me. I was given one web page where all of my stuff would go. All of the documents could be uploaded there. All of the messages between me and my loan advisor would go there. And if I didn’t check it one day, I would get a text message telling me I needed to go check it out because there was stuff to do.

Somehow, the app knew how much my taxes were. It could even verify my employment by searching public databases (although this feature didn’t work for me, but I easily uploaded the documents they needed to the site.)

It was responsive. If I left a message in the morning, someone would reply before noon. If I had a question that needed clarification, someone would text me. And if I ever needed to know what was up, I could just check the page. There were no ads trying to sell me other things. This was a page dedicated to ME, with the sole job of closing my refinance as quickly and easily as possible.

I closed on the refinance last week. They sent a title company to my home to do it. At 7pm. I didn’t have to go to them. The only mail I got were my closing documents in a box with some fun branding on it that looked like it was top secret documents and said MORTGAGE POSSIBLE and FOR YOUR EYES ONLY on it. Cheesy, yes. But, again, it was the only mail I got from them. And it felt kind of special in a Where In The World Is Carmen San Diego sort of way.

The experience I had with Rocket Mortgage from Quicken was the best ad they ever could have made. I have since learned that they worked for five years on the coding. Thousands of engineers touched the final product. Putting thought and effort into customer experience is an Inspiring Action. It made me feel modern. (Nobody mentioned a fax machine.) It made me feel personal importance. (I had my own page.) And it was all so seamless that even I couldn’t screw it up.

How are you building your brand around your customers? What elements of experience design can you use to make the sales process more modern, personal and seamless? Or are you too busy making an ad that will get more people into the funnel, where they will have to do all the work?